Professional Documents

Culture Documents

Canadian Value Fund 2QTR 2012

Canadian Value Fund 2QTR 2012

Uploaded by

jai6480Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Canadian Value Fund 2QTR 2012

Canadian Value Fund 2QTR 2012

Uploaded by

jai6480Copyright:

Available Formats

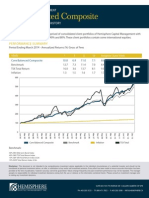

HEMISPHERE CAPITAL MANAGEMENT

Canadian Value Fund

PERFORMANCE SUMMARY AND HISTORY

The Canadian Value Fund invests primarily in high quality Canadian companies. Through a qualitative, valuebased investment approach, the Fund is managed to achieve above average long-term capital appreciation, while protecting capital during periods of significant market weakness.

PERFORMANCE SUMMARY

Period Ending June 2012 - Annualized Returns (%) Net of Fees

YEARS 1 3 5 10 Inception (May/2007)

Canadian Value

Benchmark Inflation

0.8

-10.3 2.0

10.4

6.7 1.6

4.8

-0.7 1.7

4.2

-0.8 1.7

140 120 100 80 60 40 20 0

Nov-07

Nov-08

Nov-09

Nov-10

Nov-11

May-07

Benchmark:

May-08

May-09

May-10

May-11

May-12

Canadian Value

Benchmark

Inflation

100% S&P/TSX Total Return Index

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior to making any investment decisions.

STOCK EXCHANGE BUILDING - SUITE 1280 300 5TH AVENUE SW CALGARY, ALBERTA T2P 3C4 PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

CANADIAN VALUE FUND

PAGE 2

PERFORMANCE HISTORY

Year 2007 Cdn Value Benchmark 2008 Cdn Value Benchmark 2009 Cdn Value Benchmark 2010 Cdn Value Benchmark 2011 Cdn Value Benchmark 2012 Cdn Value Benchmark -1.8% -4.7% 0.7% -3.0% -1.2% -5.3% 2.5% 1.0% 1.2% 4.4% 1.3% 3.4% -0.7% -6.3% 1.9% 5.0% 2.2% 4.4% 2.1% 1.7% 0.6% -1.4% 3.4% 7.8% 5.0% 3.8% -0.6% 0.1% -0.4% -1.6% 4.2% 4.6% 2.3% 7.3% -0.3% 1.7% -0.1% -1.0% -2.1% -0.6%

JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC

-1.2% 0.3% 3.5% 5.8% 4.5% 11.5% -1.4% -3.5% 0.8% -0.9% -2.0% -6.1%

-0.9% -0.8% 0.3% -1.4% 4.8% 0.3% 0.3% -3.7% -2.5% -3.3% -0.9% 1.1%

-1.5% -0.1% -3.0% -5.9% 0.5% 4.2% 1.1% 4.0% 2.0% -2.5%

-0.8% -1.3% -0.6% 1.5% 2.6% 0.9% 2.4% 1.9% -0.9% -1.2%

0.9% 3.5% -6.9% -14.4% 2.4% 5.1% 2.1% 4.1% -3.4% -8.7%

1.8% 3.9% -9.9% -16.7% 0.2% -4.0% 2.4% 2.7% 5.0% 5.6%

-3.3% -6.2% -2.9% -4.7% 3.2% 5.2% 2.5% 2.4% 0.3% -0.2%

0.0% 1.3% -1.9% -2.6% 1.2% 2.9% 2.3% 4.1% 0.3% -1.7%

*Investment returns for May 2007 correspond to the period May 11, 2007 to May 31, 2007.

Benchmark:

100% S&P/TSX Total Return Index

STOCK EXCHANGE BUILDING - SUITE 1280 300 5TH AVENUE SW CALGARY, ALBERTA T2P 3C4 PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Financial - Markets - and - Institutions - 9th - E Test Bank Sample PDFDocument21 pagesFinancial - Markets - and - Institutions - 9th - E Test Bank Sample PDFSewale Abate100% (1)

- Technology Startup GuideDocument86 pagesTechnology Startup GuidecrinkletizzNo ratings yet

- Mozal ExcelDocument4 pagesMozal Excelderek4wellNo ratings yet

- IBM Capital StructureDocument53 pagesIBM Capital Structureyajkr0% (1)

- Banking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andDocument10 pagesBanking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andgalilleagalillee100% (1)

- A Project Report On A STUDY of EQUITY On CAPITAL MARKETS at Indian Infoline BengloreDocument101 pagesA Project Report On A STUDY of EQUITY On CAPITAL MARKETS at Indian Infoline BengloreBabasab Patil (Karrisatte)No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite - 2QTR 2014Document2 pagesCore Balanced Composite - 2QTR 2014jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Financial MarketDocument27 pagesFinancial Marketramesh.kNo ratings yet

- Ibo 06Document4 pagesIbo 06Bhavna SinghalNo ratings yet

- Banner 25Document3 pagesBanner 25julia007No ratings yet

- Trust Account Deposit FormDocument1 pageTrust Account Deposit Formchristian09x100% (1)

- Banking & Insurance ManagementDocument2 pagesBanking & Insurance ManagementVishal Mandowara100% (1)

- Financial Market ExerciseDocument6 pagesFinancial Market ExerciseShamraj E. SunderamurthyNo ratings yet

- Chapter-1-An Overview of The Financial SystemDocument10 pagesChapter-1-An Overview of The Financial SystemHussen AbdulkadirNo ratings yet

- Basis & Basis RiskDocument10 pagesBasis & Basis RiskAnushka KavlekarNo ratings yet

- Bank MarketingDocument68 pagesBank MarketingShahzad Saif100% (1)

- Evolution of Financial SystemDocument2 pagesEvolution of Financial SystemShah SuzaneNo ratings yet

- Chapter 16Document3 pagesChapter 16Umidjon YusupovNo ratings yet

- Unit 1 - Indian Financial SystemDocument73 pagesUnit 1 - Indian Financial SystemHasrat AliNo ratings yet

- The Black-Scholes-Merton Model: Practice QuestionsDocument2 pagesThe Black-Scholes-Merton Model: Practice QuestionsHana Lee100% (1)

- Indian Financial SystemDocument16 pagesIndian Financial Systemshankarinadar100% (1)

- MBFS Financial SystemDocument40 pagesMBFS Financial SystemNagendra Basetti100% (1)

- Amanah Raya BerhadDocument2 pagesAmanah Raya BerhadSamulung CorpNo ratings yet

- Credit Card Cancellation Request Form: Important NoteDocument1 pageCredit Card Cancellation Request Form: Important NoteJarah ShahmadNo ratings yet

- Chapter 6 The Philippine Financial MarketDocument19 pagesChapter 6 The Philippine Financial MarketElijah SundaeNo ratings yet

- Topic 1: & Overview of Financial SystemDocument71 pagesTopic 1: & Overview of Financial SystemSarifah SaidsaripudinNo ratings yet

- LBO Model - ValuationDocument6 pagesLBO Model - ValuationsashaathrgNo ratings yet

- Notes:: Construction Loan - Interest RatesDocument3 pagesNotes:: Construction Loan - Interest RatesRupak Ranjan DeyNo ratings yet

- Credit Creation Economics For MbaDocument12 pagesCredit Creation Economics For Mbavinodgupta1960No ratings yet

- Balance Sheet: Ruchi Soya Industries Ltd. - Research CenterDocument3 pagesBalance Sheet: Ruchi Soya Industries Ltd. - Research CenterAjitesh KumarNo ratings yet

- Week 1FMDocument52 pagesWeek 1FMchitkarashelly100% (1)