News & Updates

LEIBOVIT VR NEWSLETTERS - 'TURNAROUND TUESDAY' - JUNE 4, 2024 - WHO TOLD YOU FRIDAY'S RALLY INTO THE CLOSE WAS A MANIPULATION (PHONY) AND WHO GOT SHORT?

Is it the 'hoped for' abolishment of the Federal Reserve (and most of Congress) , the needed ouster of anarchist judges, on going World War III, Civil War redo, risk of a Carrington (Solar Flares - CMEs) or other geocosmic event, gross manipulation and lies in the financial markets as we near a market crash, a push for forced inoculations, enhanced antisemitism, or the hidden alien-extraterrestrial presence being revealed? Believe me, there are others. All are on the table! If you are being sucked into the Nvidia trap, enjoy it but know the risks when the plug is pulled. I would equate this with the Meme stocks like GME and AMC. As you know Meme stocks are shares that swing wildly in value based on their popularity among trader communities on social media rather than the companies' fundamental characteristics. All are fun to trade and a bit safer than going to Vegas.

I reported to you that the manipulation into Friday's close was just that - manipulation - into end of the month 'window dressing' which afforded us a great opportunity to establish short (inverse index) positions which worked out great on Monday. We took profits anticipating a possible 'Turnaround Tuesday' . Don't ever tell me these patterns don't work and you certainly don't hear about them on 'do the opposite' financial television and radio.

Meanwhile, I am a bear regardless or in spite of Nividia which is a great trading vehicle how long the bulls have the street mesmerized. Maybe it will be $5000 stock. That would be great if we could catch the swings. I reported here when the stock broke into the 700s that was a good trading entry point. Between now and Friday's 10 for 1 split I suppose we could eek out a few points here and there if we're nimble.

Below is the general market news put out the brainwashed media:

U.S. Stocks Close On Mixed Note (Editor: What the hell is 'Mixed'? If you lost money, it was a bad day. If you owned Nvidia and nothing else, it was a good day)

After a positive start and a subsequent retreat that resulted in a fairly long spell in negative territory on Monday, U.S. stocks recovered in afternoon trades and ended the day's session on a mixed note.

The Nasdaq outperformed, settling at 16,828.67 with a gain of 93.65 points or 0.56 percent. The S&P 500 edged up 5.89 points or 0.11 percent to finish at 5,283.40, while the Dow ended down 115.29 points or 0.3 percent at 38,571.03.

Data showing a contraction in the nation's manufacturing activity in the month of May hurt sentiment.

A report from the Institute for Supply Management said manufacturing activity in the U.S. unexpectedly contracted at a slightly faster rate in the month of May, edging down to 48.7 in the month, from 49.2 in April. Economists had

expected the index to inch up to 49.6.

The report also said the prices index slid to 57.0 in May from 60.9 in April, suggesting a slowdown in the pace of price growth.

On Wednesday, the ISM is scheduled to release a separate report on service sector activity in the month of May. The services PMI is expected to rise to 50.5 in May from 49.4 in April, with a reading above 50 indicating growth.

Preliminary data from the U.S. Censuc Bureau showed US construction spending shrunk unexpectedly in April amid declines in both private and public construction.

The report said construction spending dipped 0.1% to $2,099.0 billion from the revised estimate of $2,101.5 billion in March. Spending was expected to grow 0.2 percent after a 0.2 percent decrease in March. The unexpected decrease by the

headline index partly reflected a faster contraction in new orders, as the new orders index fell to 45.4 in May from 49.1 in April.

The production index also slipped to 50.2 in May from 51.3 in April, although a reading above 50 still indicates growth.

Meanwhile, the ISM said the employment index rose to 51.1 in May from 48.6 in April, indicating a rebound by employment during the month.

Several stocks from financial and energy sectors ended sharply lower.

Autodesk climbed about 4.6 percent. Moderna, Vertex Pharmaceuticals, Dollar Tree, Micron Technology, Starbucks, Biogen and Meta Platforms gained 2 to 4 percent.

Salesforce.com climbed about 2.75 percent. AstraZeneca, Warner Bros., Amazon, Merck, Boeing and American Express posted moderate gains.

Sirius XM, Walgreens Boots Alliancec, AMD, Old Dominion Freight Line and Baker Hughes ended sharply lower.

In overseas trading, Asian stocks rallied on Monday as soft U.S. inflation data revived rate cut hopes and a private survey showed China's factory activity grew the fastest in about two years in May due to production gains and new

orders.

European markets closed largely higher on Monday with investors picking up stocks, looking ahead to the European Central Bank's monetary policy announcement due later in the week.

There are expectations that the ECB will deliver its first interest-rate cut of the cycle on Thursday.

The pan European Stoxx 600 climbed 0.32 percent. Germany's DAX gained 0.6 percent, and France's CAC 40 edged up 0.06 percent. The U.K.'s FTSE 100 ended down by 0.15 percent.

Yes, that's a cartoon of me. Louis Rukeyser had us dressed up in 'elf' costumes on the screen broadcast each week. I've dated myself. That occurred for me between 1988-1996. Lou didn't like any bearish comments, so myself and other elves got dumped in 1996.

WHO am I?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

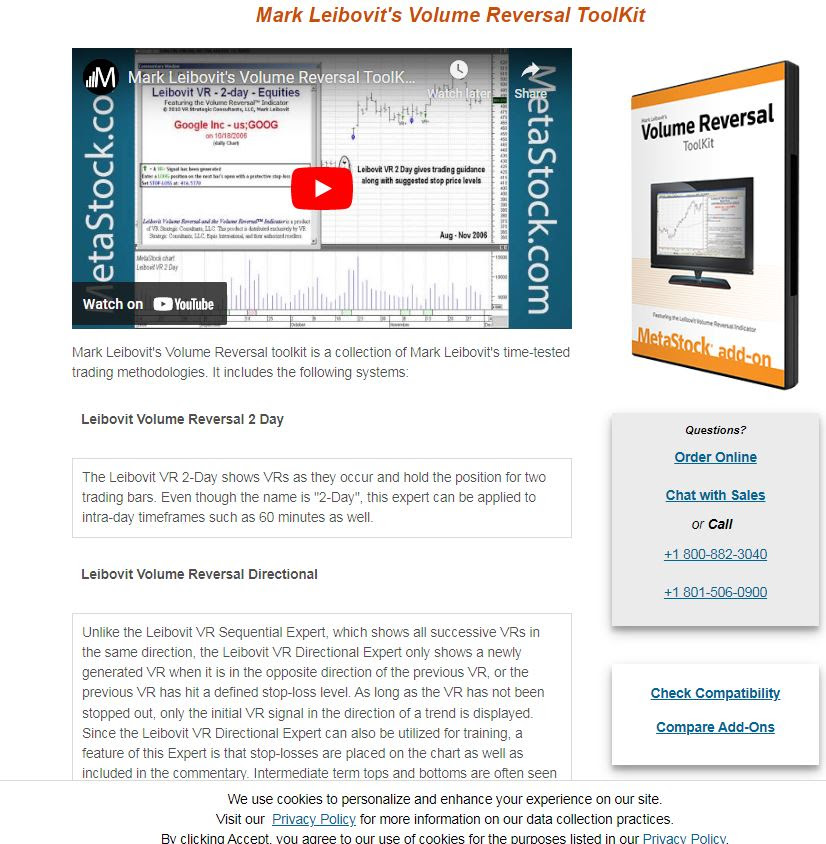

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada.

https://massie.house.gov/uploadedfiles/endthefed.pdf

The questions CFTC and Fed won't answer expose gold price suppression policy

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

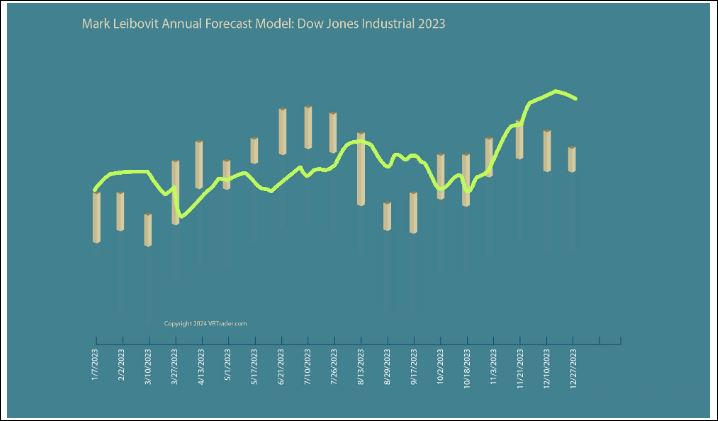

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

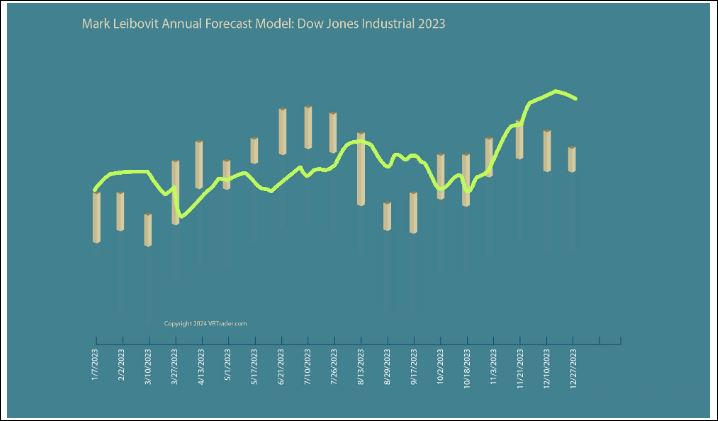

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

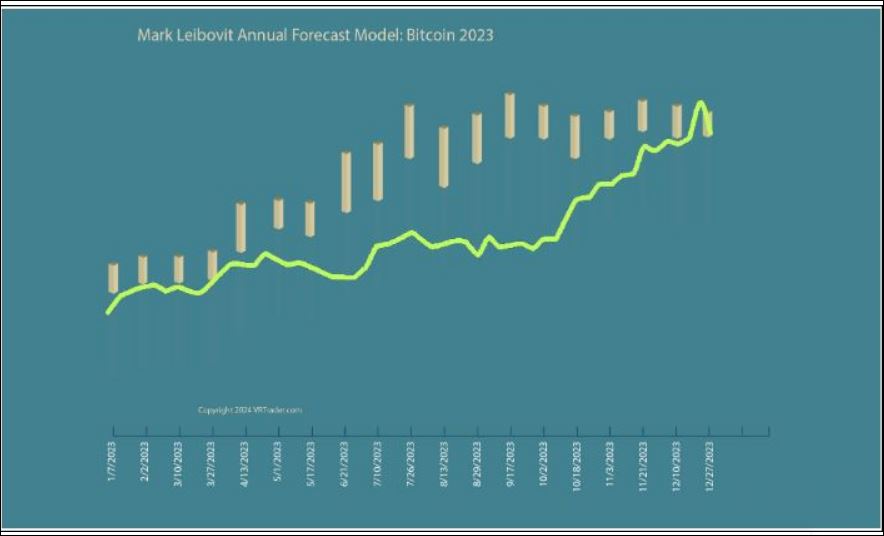

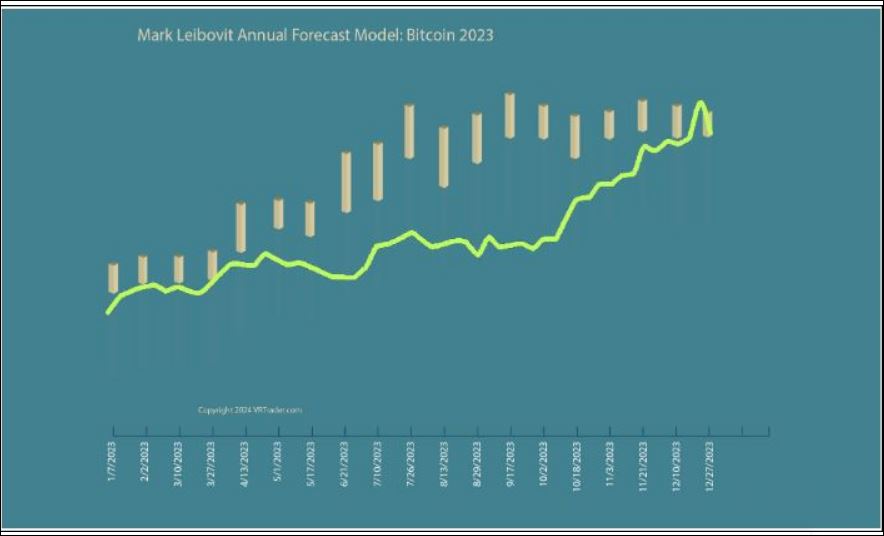

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://tinyurl.com/2rd9wv52

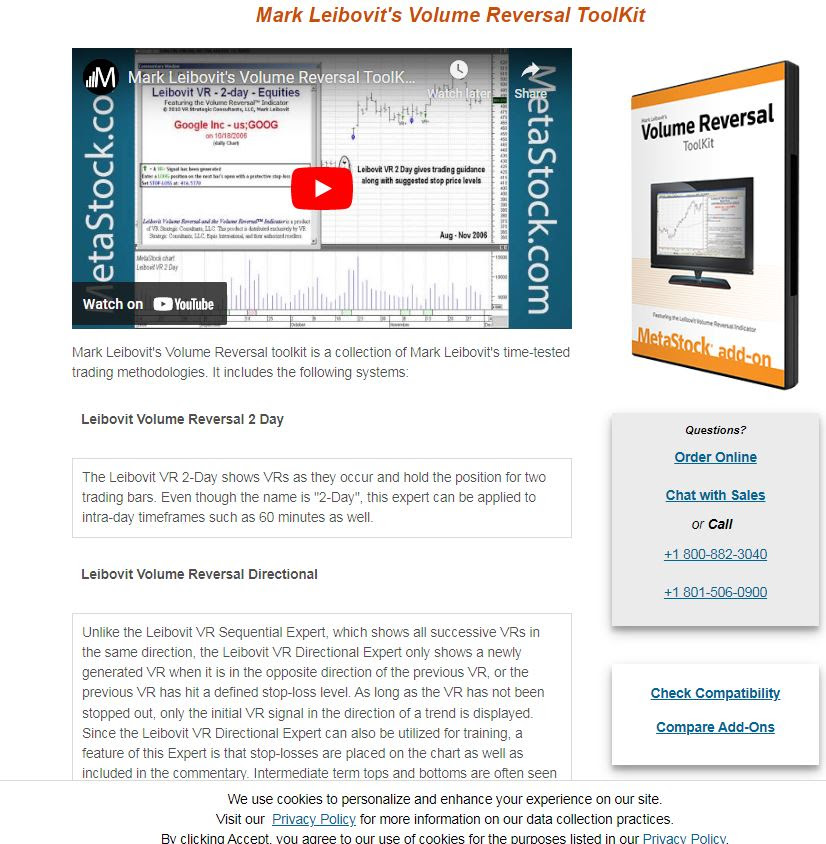

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

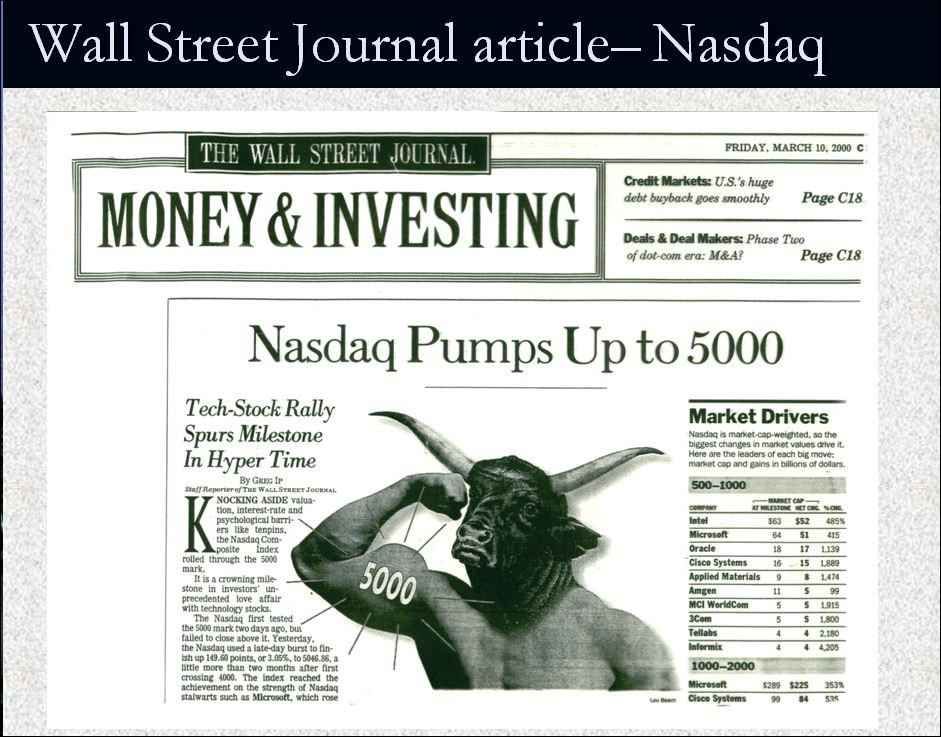

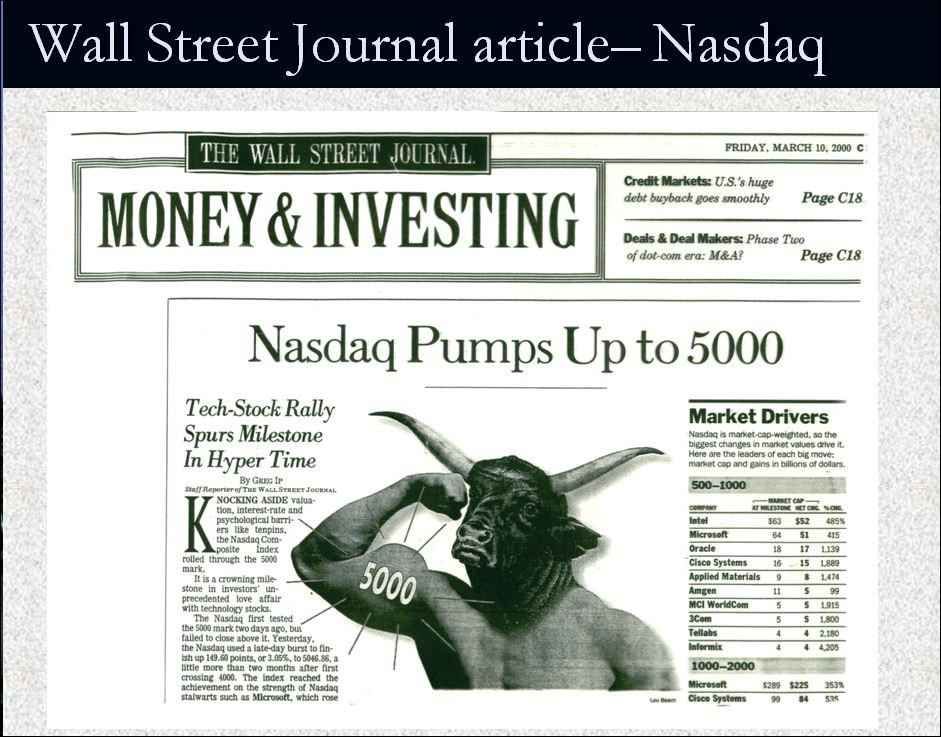

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

------------------------------

2. WATCH THE FULL ROSWELL MOVIE PRODUCED IN THE 1990s

https://www.disclose.tv/roswel

THE ADAMS EVENT

The magnetic north pole – that is, the direction a compass needle points to – doesn’t have a fixed location. It usually wobbles close to the North Pole (the northern-most point of Earth’s axis) over time due to dynamic movements within the Earth’s core, just like the magnetic south pole.

Sometimes, for reasons that aren’t clear, the magnetic poles’ movements can be more drastic. Around 41,000-42,000 years ago they swapped places entirely.

“The Laschamps Excursion was the last time the magnetic poles flipped,” says Prof. Turney. “They swapped places for about 800 years before changing their minds and swapping back again.”

Until now, scientific research has focused on changes that happened while the magnetic poles were reversed, when the magnetic field was weakened to about 28 per cent of its present-day strength.

But according to the team’s findings, the most dramatic part was the lead-up to the reversal, when the poles were migrating across the Earth.

“Earth’s magnetic field dropped to only 0-6 per cent strength during the Adams Event,” says Prof. Turney.

“We essentially had no magnetic field at all – our cosmic radiation shield was totally gone.”

During the magnetic field breakdown, the Sun experienced several ‘Grand Solar Minima’ (GSM), long-term periods of quiet solar activity.

Even though a GSM means less activity on the Sun’s surface, the weakening of its magnetic field can mean more space weather – like solar flares and galactic cosmic rays – could head Earth’s way.

“Unfiltered radiation from space ripped apart air particles in Earth’s atmosphere, separating electrons and emitting light – a process called ionisation,” says Prof. Turney.

“The ionised air ‘fried’ the Ozone layer, triggering a ripple of climate change across the globe.”

https://www.unsw.edu.au/newsro

I USE JOEL WALLACH'S SUPPLEMENTS EVERY DAY. MAY AGAIN PROVIDE A LINK TO PURCHASE THEM HERE

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.

LEIBOVIT VR NEWSLETTERS - MONDAY - JUNE 3, 2024 - MANIPULATION REIGNED SUPREME INTO END OF THE MONTH WINDOW DRESSING!

Is it the abolishment of the FED, political assassinations, World War III, Civil War, risk of a Carrington or other geocosmic event, gross manipulation and lies in the financial markets as we near a market crash, a push for forced inoculations, enhanced antisemitism, or the hidden alien-extraterrestrial presence being revealed? Believe me, there are others. All are on the table!

Rising Treasury Yields Contribute To Weakness On Wall Street

Following the mixed performance seen during Tuesday's session, the major U.S. stock indexes all moved to the downside

during trading on Wednesday. The Dow showed a notable decline, falling to its lowest closing level in almost a month.

The major averages all finished the day firmly in negative territory. The Dow slumped 411.32 points or 1.1 percent to

38,441.54, the S&P 500 slid 39.09 points or 0.7 percent to 5,266.95 and the Nasdaq fell 99.30 points or 0.6 percent to

16,920.58.

The weakness on Wall Street came amid a continued increase by treasury yields, with the yield on the benchmark ten-year

note climbing to its highest levels in nearly a month.

The ten-year yield jumped above 4.5 percent on Tuesday, as auctions of two-year and five-year notes attracted well below

average demand.

The continued advance by treasury yields has added to recent concerns about the outlook for interest rates ahead of key

inflation data later in the week.

On Friday, the Commerce Department is due to release its report on personal income and spending in the month of April,

which includes readings on inflation said to be preferred by the Federal Reserve.

The inflation data could have a significant impact on the outlook for interest rates ahead of the Fed's next monetary

policy meeting on June 11-12.

In an interview with CNBC on Tuesday, Minneapolis Fed President Neel Kashkari said he needs to see "many more months of

positive inflation data" before he would consider cutting interest rates.

Kashkari, who does not have a vote on the rate-setting Federal Open Market Committee this year, also said he could not rule

out raising interest rates if inflation fails to slow.

Traders may also have been cashing on recent strength in the tech sector, which drove the Nasdaq to a new record closing

high on Tuesday amid a surge by shares of Nvidia (NVDA).

A pullback by the price of crude oil led to considerable weakness among energy stocks, dragging both the NYSE ARCA Oil

Index and the Philadelphia Oil Service Index down by 2.2 percent.

Airline stocks also saw substantial weakness on the day, with the NYSE Arca Airline Index plunging by 2.0 percent to a

nearly six-month closing low.

America Airlines (AAL) led the sector lower, plummeting by 13.5 percent after the airline lowered its second quarter

earnings guidance.

Gold stocks also saw significant weakness amid a decrease by the price of the precious metal, moving notably lower along

steel, semiconductor and telecom stocks.

Other Markets

In overseas trading, stock markets across the Asia-Pacific region moved mostly lower during trading on Wednesday. Japan's

Nikkei 225 Index fell by 0.8 percent, while Hong Kong's Hang Seng Index plunged by 1.8 percent.

The major European markets have also moved to the downside on the day. While the French CAC 40 Index tumbled by 1.5

percent, the German DAX Index slumped by 1.1 percent and the U.K.'s FTSE 100 Index slid by 0.9 percent.

In the bond market, treasuries extended the notable downward move seen in the previous session. As a result, the yield on

the benchmark ten-year note, which moves opposite of its price, surged 8.2 basis points to a nearly one-month closing high

of 4.624 percent.

Looking Ahead

Reports on weekly jobless claims, first quarter GDP and pending home sales may attract attention on Thursday, although

trading activity may be somewhat subdued ahead of the release of the closely watched inflation data on Friday.

WHO IS MARK LEIBOVIT?

MARK LEIBOVIT is Chief Market Strategist for LEIBOVIT VR NEWSLETTERS a/k/a VRTrader.Com. His technical expertise is in overall market timing and stock selection based upon his proprietary VOLUME REVERSAL (TM) methodology and Annual Forecast Model.

Mark's extensive media television profile includes seven years as a consultant ‘Elf’ on “Louis Rukeyser’s Wall Street Week” television program, and over thirty years as a Market Monitor guest for PBS “The Nightly Business Report”. He also has appeared on Fox Business News, CNBC, BNN (Canada), and Bloomberg, and has been interviewed in Barrons, Business Week, Forbes and The Wall Street Journal and Michael Campbell's MoneyTalks.

In the January 2, 2020 edition of TIMER DIGEST MAGAZINE, Mark Leibovit was ranked the #1 U.S. Stock Market Timer and was previously ranked #1 Intermediate U.S. Market Timer for the ten year period December, 1997 to 2007.

He was a 'Market Maker' on the Chicago Board Options Exchange and the Midwest Options Exchange and then went on to work in the Research department of two Chicago based brokerage firms. Mr. Leibovit now publishes a series of newsletters at www.LeibovitVRNewsletters.com. He became a member of the Market Technicians Association in 1982.

Mr. Leibovit’s specialty is Volume Analysis and his proprietary Leibovit Volume Reversal Indicator is well known for forecasting accurate signals of trend direction and reversals in the equity, metals and futures markets. He has historical experience recognizing, bull and bear markets and signaling alerts prior to market crashes. His indicator is currently available on the Metastock platform.

His comprehensive study on Volume Analysis, The Trader’s Book of Volume published by McGraw-Hill is a definitive guide to volume trading. It is now also published in Chinese. Mark has appeared in speaking engagements and seminars in the U.S. and Canada.

https://massie.house.gov/uploadedfiles/endthefed.pdf

The questions CFTC and Fed won't answer expose gold price suppression policy

Gold market manipulation: Why, how, and how long? (2021 edition)

https://gata.org/node/20925

The President's Working Group on Financial Markets

known colloquially as the Plunge Protection Team, or "(PPT)" was created by Executive Order 12631,[1] signed on March 18, 1988, by United States President Ronald Reagan.

As established by the executive order, the Working Group has three purposes and functions:

"(a) Recognizing the goals of enhancing the integrity, efficiency, orderliness, and competitiveness of our Nation's financial markets and maintaining investor confidence, the Working Group shall identify and consider:

(1) the major issues raised by the numerous studies on the events in the financial markets surrounding October 19, 1987, and any of those recommendations that have the potential to achieve the goals noted above; and

(2) the actions, including governmental actions under existing laws and regulations (such as policy coordination and contingency planning), that are appropriate to carry out these recommendations.

(b) The Working Group shall consult, as appropriate, with representatives of the various exchanges, clearinghouses, self-regulatory bodies, and with major market participants to determine private sector solutions wherever possible.

(c) The Working Group shall report to the President initially within 60 days (and periodically thereafter) on its progress and, if appropriate, its views on any recommended legislative changes."

Plunge Protection Team

"Plunge Protection Team" was originally the headline for an article in The Washington Post on February 23, 1997, and has since been used by some as an informal term to refer to the Working Group. Initially, the term was used to express the opinion that the Working Group was being used to prop up the stock markets during downturns.[5 Financial writers for British newspapers The Observer and The Daily Telegraph, along with U.S. Congressman Ron Paul, writers Kevin Phillips (who claims "no personal firsthand knowledge" and John Crudele,[8] have charged the Working Group with going beyond their legal mandate.[failed verification] Charles Biderman, head of TrimTabs Investment Research, which tracks money flow in the equities market, suspected that following the 2008 financial crisis the Federal Reserve or U.S. government was supporting the stock market. He stated that "If the money to boost stock prices did not come from the traditional players, it had to have come from somewhere else" and "Why not support the stock market as well? Moreover, several officials have suggested the government should support stock prices."

In August 2005, Sprott Asset Management released a report that argued that there is little doubt that the PPT intervened to protect the stock market.[10] However, these articles usually refer to the Working Group using moral suasion to attempt to convince banks to buy stock index futures.

Former Federal Reserve Board member Robert Heller, in the Wall Street Journal, opined that "Instead of flooding the entire economy with liquidity, and thereby increasing the danger of inflation, the Fed could support the stock market directly by buying market averages in the futures market, thereby stabilizing the market as a whole." Author Kevin Phillips wrote in his 2008 book Bad Money that while he had no interest "in becoming a conspiracy investigator", he nevertheless drew the conclusion that "some kind of high-level decision seems to have been reached in Washington to loosely institutionalize a rescue mechanism for the stock market akin to that pursued...to safeguard major U.S. banks from exposure to domestic and foreign loan and currency crises." Phillips infers that the simplest way for the Working Group to intervene in market plunges would be through buying stock market index futures contracts, either in cooperation with major banks or through trading desks at the U.S. Treasury or Federal Reserve.

What is the Plunge Protection Team?

(PPT) is an informal term for the Working Group on Financial Markets. The working group was created in 1988 by then U.S President Ronald Reagan following the infamous October 1987 Black Monday crash. It was formed to re-establish consumer confidence and take steps to achieve economic and market stability in the aftermath of the market crash. The U.S president consults with the team during times of economic uncertainty and turbulence in the markets.

The Working Group on Financial Markets’ informal name “Plunge Protection Team” was coined and popularized by The Washington Post in 1997.

What does the Plunge Protection Team Do?

The Plunge Protection Team was initially formed to advise the president and regulatory agencies on countering the negative impacts of the stock market crash of 1987. However, the team has continued to report to various presidents since that stock market crash and has met various U.S presidents on important financial matters over the years.

The team was believed to be behind the rally in the stock market shortly after a hefty drop in the Dow Jones Industrial Average (DJIA) on February 05, 2018. As per some market observers, after the plunge, the market made a smart recovery in the following days, which may have been a result of heavy buying by the Plunge Protection Team.

Who is on the plunge protection team?

The PPT several top government economic and financial officials. The Secretary of the Treasury heads the group, while the Chair of the Board of Governors of the Federal Reserve, the Chair of the Commodity Futures Trading Commission, and the Chair of the Securities and Exchange Commission, are also part of the team.

Why is the PPT secretive?

The Plunge Protection Team’s meetings or activities aren’t covered by the media, which gives rise to speculations and conspiracy theories about the team. The probable reason behind the secretive nature of its activities is that it reports only to the president. Some observers opine that the team’s role is not only limited to giving recommendations to the president; rather, the team intervenes in the market and artificially props up stock prices.

Critics claim that the members connive with big banks and profit from stock markets by carrying out trades on different stock exchanges when prices decline. They then artificially prop up the prices as part of their market stabilization efforts and profit from their transactions.

When does/have the PPT meet?

Although very little has come out in the mainstream media about the group’s activities, there have been some instances when the team’s meetings were reported. For example, in 1999, the team proposed to congress to incorporate some changes in the derivatives markets regulations. The last reported meeting of the group, at the time of this writing in June 2022, was in December 2018 when Treasury Secretary Steven Mnuchin headed the teleconference with the group’s members. Representatives from the Federal Deposit Insurance Corporation and the Comptroller of the Currency also attended the meeting.

Before the teleconference that took place on December 24, 2018, the S&P 500 and the DJIA had been under pressure for the whole month. But after Christmas, the DJIA and the S&P 500 both recovered and reversed most of the losses in the next few days. Conspiracy theorists attribute the recovery and gains in the indices to the intervention by the Plunge Protection Team.

Final Thoughts

The Working Group on Financial Markets serves an important function: to advise the president on financial markets and economic affairs. Because the exact nature of the group’s activities or recommendations haven't been made public, some critics of the group blame the group for market intervention and artificially propping up stocks’ prices. However, some market observers believe that the team’s quiet activities are excused as it reports directly to the president.

The Exchange Stabilization Fund protects the FED.

We already know the FED is lying that raising interest rates will reduce price inflation. The Exchange Stabilization Fund (ESF) is an emergency reserve account that can be used by the U.S. Department of Treasury to mitigate instability in various financial sectors, including credit, securities, and foreign exchange markets. The U.S. Exchange Stabilization Fund was established at the Treasury Department by a provision in the Gold Reserve Act of 1934.

https://en.wikipedia.org/wiki/

THE VR FORECASTER - ANNUAL FORECAST MODEL

ORDER TODAY AND WE WILL MANUALLY EMAIL YOU THE REPORT BEFORE IT IS POSTED ON THE WEBSITE

HERE IS THE 2023 ANNUAL FORECAST MODEL WITH THE 'RESULTS' SUPERIMPOSED

HERE IS THE 2023 ANNUAL FORECAST MODEL FOR BITCOIN WITH THE 'RESULTS' SUPERIMPOSED

ORDER PAGE

http://tinyurl.com/5f7wb6zs

https://tinyurl.com/2rd9wv52

OPPORTUNITY TO ACCESS MARK LEIBOVIT'S PROPRIETARY VOLUME REVERSAL INDICATOR - THIS IS THE ONLY PLACE TO DO IT!

https://www.metastock.com/prod

FOLKS THIS ALL YOU NEEDED TO KNOW! HISTORICALLY A GOOD SIGN THAT WE ARE AT OR NEAR A MARKET TOP = BULLISH MEDIA HEADLINES LIKE THIS. RECALL THE MARCH 10, 2000 TOP HEADLINE IN THE WALL STREET JOURNAL (BELOW) RIGHT AT THE TOP!

COME ON, DAD. IT'S TIME TO EAT

DISCLAIMER:

WE ARE NOT FINANCIAL ADVISORS AND DO NOT PROVIDE FINANCIAL ADVICE

The website, LeibovitVRNewsletters.com, is published by LeibovitVRNewsletters LLC.

In using LeibovitVRnewsletters.com (a/k/a LeibovitVRNewsletters LLC) you agree to these Terms & Conditions governing the use of the service. These Terms & Conditions are subject to change without notice. We are publishers and are not registered as a broker-dealer or investment adviser either with the U.S. Securities and Exchange Commission or with any state securities authority.

All stocks and ETFs discussed are HYPOTHETICAL and not actual trades whose actual execution may differ markedly from prices posted on the website and in emails. This may be due internet connectivity, quote delays, data entry errors and other market conditions. Hypothetical or simulated performance results have certain inherent limitations as to liquidity and execution among other variables. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE FORECASTING ACCURACY OR PROFITABLE TRADING RESULTS.

All investments are subject to risk, which should be considered on an individual basis before making any investment decision. We are not responsible for errors and omissions. These publications are intended solely for information and educational purposes only and the content within is not to be construed, under any circumstances, as an offer to buy or to sell or a solicitation to buy or sell or trade in any commodities or securities named within.

All commentary is provided for educational purposes only. This material is based upon information we consider reliable. However, accuracy is not guaranteed. Subscribers should always do their own investigation before investing in any security. Furthermore, you cannot be assured that your will profit or that any losses can or will be limited. It is important to know that no guarantee of any kind is implied nor possible where projections of future conditions in the markets are attempted.

Stocks and ETFs may be held by principals of LeibovitVRNewsletters LLC whose personal investment decisions including entry and exit points may differ from guidelines posted.

LeibovitVRNewsletters.com cannot and do not assess, verify or guarantee the suitability or profitability of any particular investment. You bear responsibility for your own investment research and decisions and should seek the advice of a qualified securities professional before making any investment. As an express condition of using this service and anytime after ending the service, you agree not to hold LeibovitVRNewsletters.com or any employees liable for trading losses, lost profits or other damages resulting from your use of information on the Site in any form (Web-based, email-based, or downloadable software), and you agree to indemnify and hold LeibovitVRNewsletters.com and its employees harmless from and against any and all claims, losses, liabilities, costs, and expenses (including but not limited to attorneys' fees) arising from your violation of this agreement. This paragraph is not intended to limit rights available to you or to us that may be available under the federal securities laws.

For rights, permissions, subscription and customer service, contact the publisher at mark.vrtrader@gmail.com or call at 928-282-1275 or mail to 10632 N. Scottsdale Road B-426, Scottsdale, AZ 85254.

The Leibovit Volume Reversal, Volume Reversal and Leibovit VR are registered trademarks.

© Copyright 2024. All rights reserved.