We have Revolutionized the way you obtain your Life Insurance in Canada.

We present an innovative way to obtain your life insurance in Canada, with practicality, safety, and the best cost-benefit ratio.

- Includes your whole family.

- No intermediary fees.

24/7

With Chatbot + Human Support (9am - 5pm)

24/7

With Chatbot + Human Support (9am - 5pm)

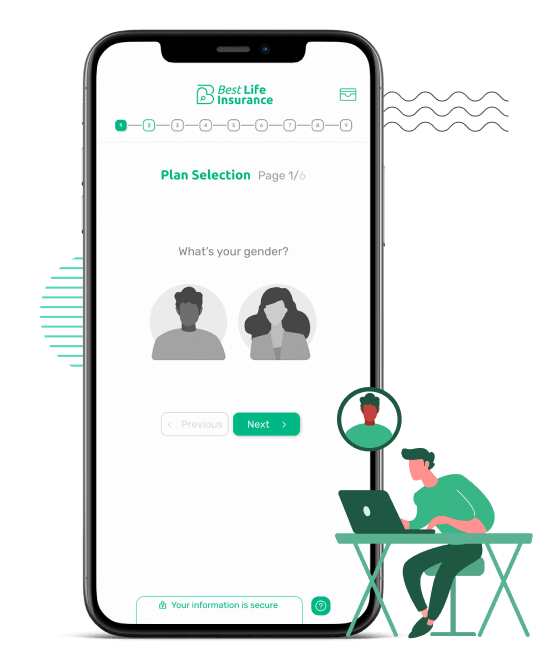

Start the process to peace of mind in just a few minutes

Get your quote NOW

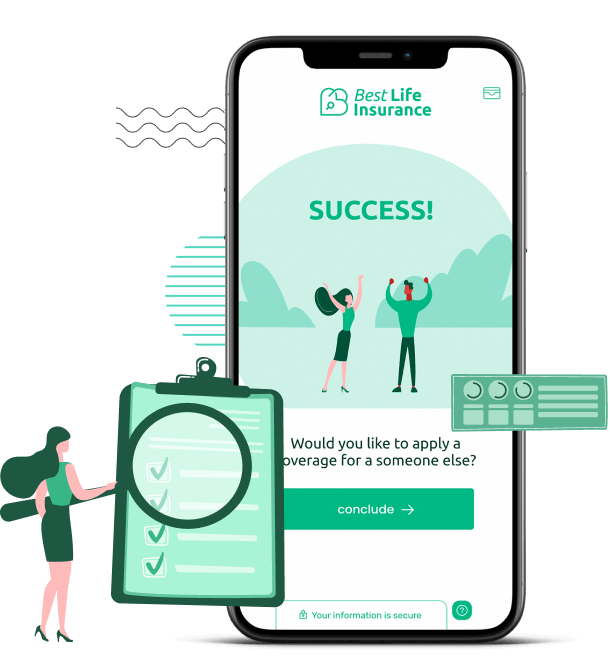

Find out if you've been approved

Activate your insurance

Get your quote NOW

Get an instant quote through our platform by answering a few questions.

Find out if you've been approved

Often, just a few pieces of information are enough for approval.

Activate your insurance

Make your payment on time and have your insurance activated.

Why buy insurance for you and your family?

Transparency and speed. Transfer your life risk to a serious company that has a strategy for you to guarantee a future for your family, company or others involved.

Why buy insurance for you and your family?

Transparency and speed. Transfer your life risk to a serious company that has a strategy for you to guarantee a future for your family, company or others involved.

Your family's safety should be a priority.

If you are responsible for other people, such as children or financial dependents, having life insurance is a way to ensure that they will be protected if something happens to you.

Minimize possible risks and impacts.

The death of a loved one is difficult in itself, whether it is the loss of a spouse, child, friend, or key employee. Having life insurance can help minimize these impacts.

Protect the future of your Business.

Life insurance for partners or key employees is essential to reduce risks and uncertainties, as well as to attract investors and financiers to the business.

What makes us Best Life Insurance

Best plans. Best prices. Only pay for what you really need. All plans come with award-winning 24/7 customer support.

Bestlifensurance.ca

Others companies

About Best Life Insurance

We are an innovative insurance broker that is taking the industry by storm. Launched in April 2023, we are here to stay.

Led by a team of experienced partners with over 20 years of experience in the insurance industry, we quickly gained a reputation for providing high-quality insurance policies and exceptional customer service. Our focus on customer satisfaction is evident in their lightning-fast online policy sales, which outpace our competitors in the market.

One thing that sets our Insurance apart is its commitment to transparency and honesty. The company is upfront about its pricing and coverage options, ensuring that customers always know what they get when purchasing a policy. This level of transparency has earned the trust of many customers who value honesty and straightforwardness in insurance providers.

Another key factor in the success of Best Life Insurance is our dedication to utilizing the latest technology and digital tools to streamline our services. Our online platform is user-friendly and intuitive, making purchasing insurance policies a breeze. This focus on digital innovation has allowed us to be more agile and efficient than traditional insurance brokers, offering our customers faster and more responsive services.

Security

Accessibility

Partner and investor company

What our partners and clients say

4.83 Average

1746 Reviews

Frequently Asked Questions (FAQ)

Pick a topic to help find answers to your insurance questions, or check out our top 4 most asked questions below.

Protect your life and the people you love with life insurance.

Protect your life and the people you love with life insurance.

1-866-561-7499

Monday–Friday: 9:00AM–5:00PM

MENU

© 2023, Solutions Financial PCC Inc. (FSRA #32994M) Solutions Financial PCC Inc. is licensed to operate in: Alberta, Saskatchewan, Manitoba, Ontario, Prince Edward Island, Nova Scotia, Newfoundland, and New Brunswick. They offer policies through several reputable insurance companies, including Manufacturers Life Insurance Company, Canada Protection Plan, BMO Life Assurance Company, Wawanesa Life Insurance, Foresters Financial, Beneva, Canada Life, RBC, Sun Life, Industrial Alliance, Assumption, Ivari, Humania, Equitable Life, UV Insurance, and Desjardins.

© 2023 Best Life Insurance – Developed by Somakers