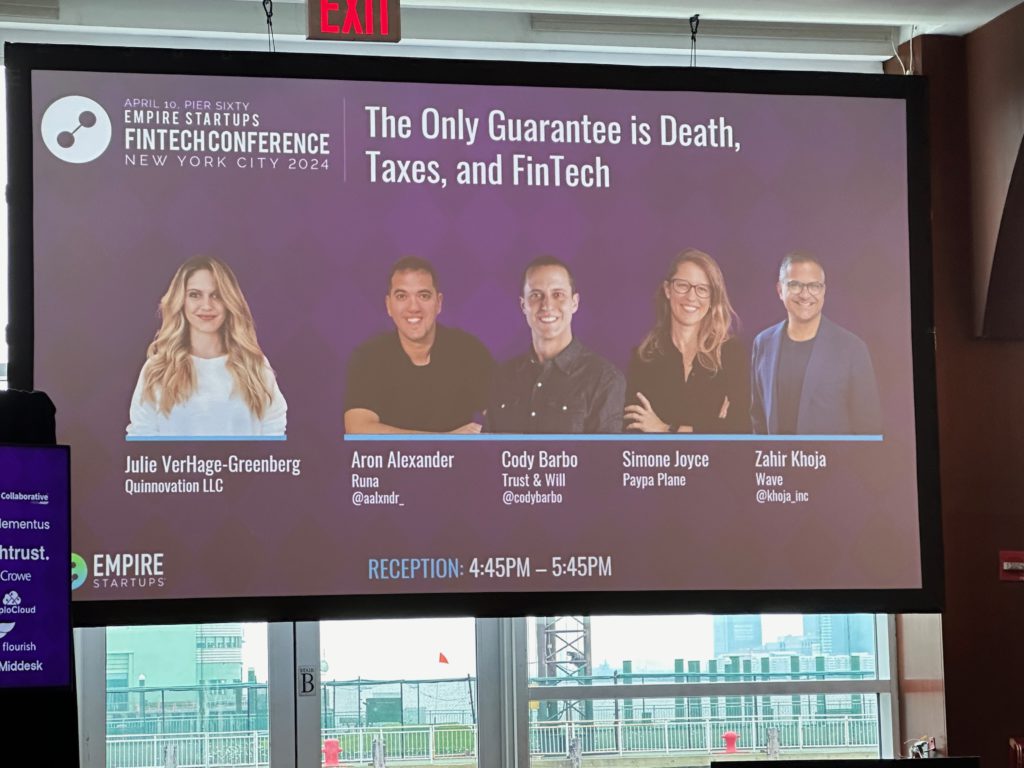

It’s a sign of strong conference content when you are constantly wish you could be in every conversation track at the same time. Thanks to Empire Startups for putting together a stacked program for this year’s Empire Fintech Conference as part of New York Fintech Week 2024.

It’s time for new cores and foundations

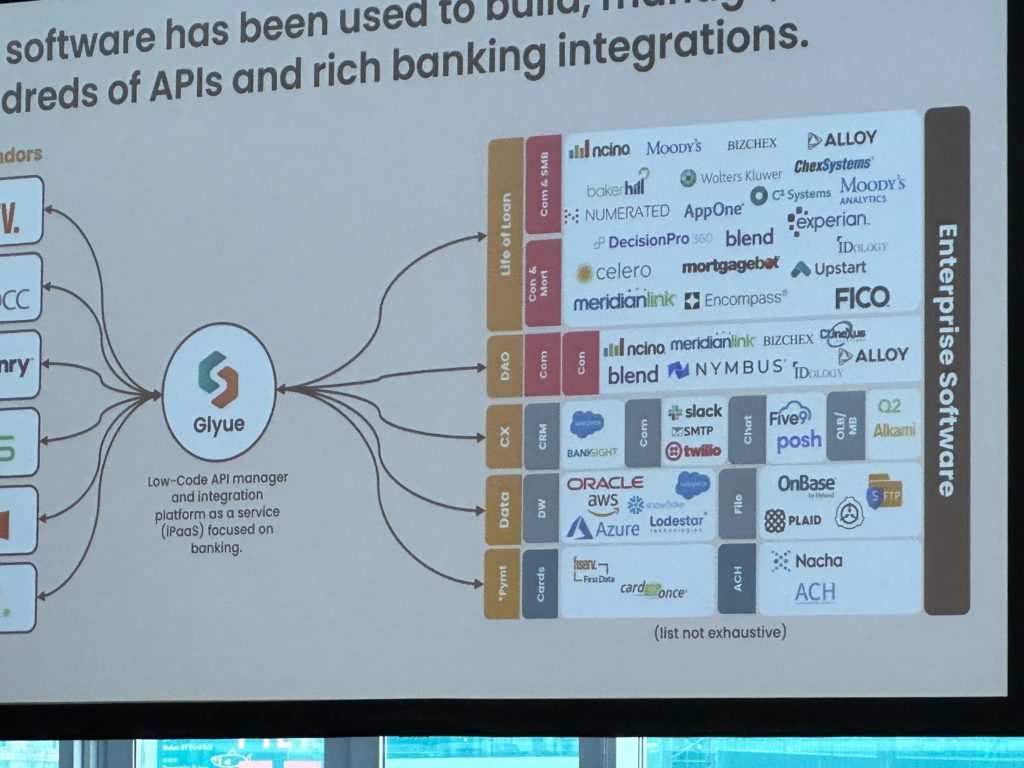

It’s amazing how far we’ve managed to get with digital-first banking and payments as well as embedded finance in the last several years, given the core systems tech that underpins it all. But between the rash of compliance actions, and the inevitable continued growth of AI and real-time services, it’s time to re-invest in the core. It’s going to take time and investment, but our institutions need move to systems that can act and settle in real-time vs batch, that properly support multi-tenant distribution partnerships with fintechs, that carry richer data with every transaction. And do all of the above with reliability, observability and enable scalable compliance and risk-management solutions for every more complex and faster-moving ecosystems.

It’s time for a third act in BaaS (Banking as a service)

American Bank regulators are cracking down on laissez-faire operational models of renting bank licenses to fintechs. For banks this all means there no more ‘easy button’ using fintech channels to grow ‘free’ balances, and no outsourcing compliance/risk policies to fintechs or middleware intermediaries. For Fintechs, it means it’s going to be harder to find bank partners, and you are going to need a more direct relationship. The original sin here, was hacking legacy bank that were never built for multi-tenant fintech usecases and not for the scale and growth of fintech usecases. Think: fintechs suddenly growing to handle millions of realtime ledger transactions per day, then trying to settle and reconcile all those transactions to 2-3 ‘real’ bank end bank accounts. Once per day. Manually. In batch more. You can understand the scaling problems. The path forward: Besides re-investments in core systems, direct relationships and stronger oversight between Banks and Fintechs. For better or worse, we’re also getting more clarity on regulatory expectations. Short term pains for more durable, reliable and compliant frameworks going forward.

Soon, real open Banking for the US?

The clock is ticking.CFPB Section 1033 is coming to officially open up Bank Data in the US. The big provisions give consumers right to access and share their bank data with 3rd parties. In principle consumers should also finally get important data privacy rights to prevent some of the shadier side of wholesale data brokering. But as these things go, the initial version still leaves much to be desired. Overzealous in some areas and too narrow in others. The biggest gap is that only narrowly-defined consumer banking data is being opened up, businesses are left out so are wealth management accounts, mortgages and more. Ironically, those are also the categories where there’s probably the most value to be created with open banking tools. Nonetheless both incumbents and fintechs need to be preparing. New strategic risks and operational challenges definitely await, but so do significant new business model opportunities.

Of course AI, but not exactly ChatGPT

It’s turning out that the killer app for AI in financial services is… a lot of different kinds of AI, ML and sometimes LLM models, but more narrowly scoped and specifically trained to solve specific tasks or workflow steps, vs a big generalized AI being the whole product. Also typically AI in support of human processes vs being directly customer facing. A lot of talk of AI underwriting, claims adjusting, payment dispute handling or AI tax/wealth advisory etc.. But for now the killer app for AI is in just parsing and organizing all the inputs vs replacing any critical decision making. At least until multi-modal models, more observable models, models that do better at math etc. can be more easily combined and trusted. (so give that just another 18 months or so?…)

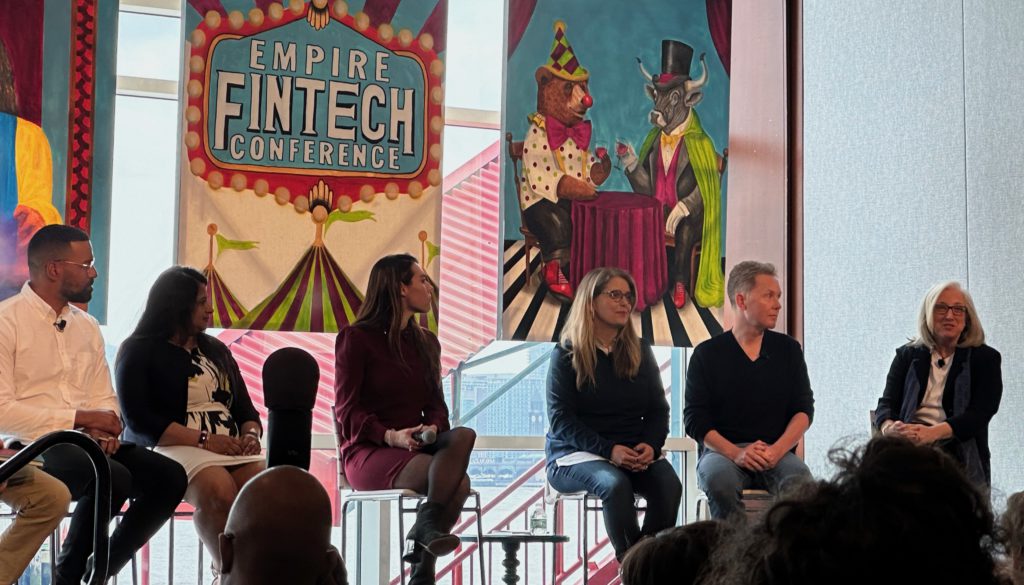

The investment opportunities are still out there

Look for where value is high but NPS scores are low. We heard about fintechs finding their wedge by fixing 401k rollover experience, digitizing wills and estate planning, the car financing and underwriting experience, using open banking to intelligently schedule payments to avoid overdrafts, and many more

Personal Bonus

PS. special mention to Skipify carrying forward the torch for easier/faster checkout across the web. Now with a Visa Click to Pay partnership they are now both figuratively as well as literally the spiritual successor to my own baby, the Visa Checkout wallet. Go Skipify!